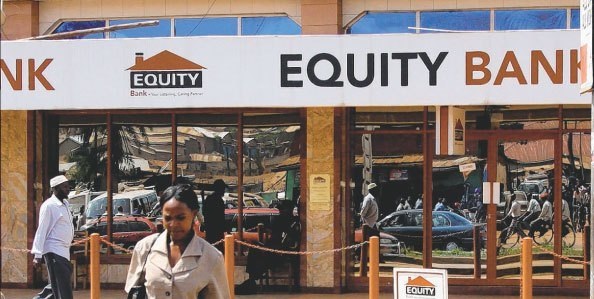

Equity Bank Uganda’s Ex-ED Arrested in Fraud Probe – The Black Examiner

Summary:

Former Executive Director for Commercial Banking at Equity Bank Uganda, Kenneth Onyango, has been arrested by Ugandan authorities in connection with suspected fraud involving stock loans and agent float financing.

Equity Bank Uganda’s former Executive Director for Commercial Banking, Kenneth Onyango, has been apprehended by Ugandan authorities in connection to an ongoing probe into suspected stock loans and agent float financing fraud, sources confirmed to Examiner.

According to reports obtained by Examiner late Thursday, Onyango was detained on directives from the Directorate of Public Prosecutions (DPP), with investigations currently underway regarding his alleged involvement in the fraud case.

“While in police custody, Onyango’s fate awaits guidance from the DPP regarding subsequent actions,” a source told Examiner.

Images circulating on social media platforms Thursday evening depicted Onyango in handcuffs, following his reported resignation from the bank the previous month. Equity Bank purportedly accepted his resignation “immediately,” contingent upon the investigation’s outcomes, which were already in progress at the time.

Kampala Metropolitan Police reportedly carried out the arrest, with spokesperson Patrick Onyango declining to comment on the matter. Formal details regarding the arrest are expected to be released by the police on Friday.

Equity Bank Uganda has refrained from providing comments on the arrest, citing the ongoing state law enforcement investigations and the potential risk of compromising inquiries.

In a statement dated March 7, 2024, Equity Bank addressed concerns over potential fraud in its stock loan and agent financing products, indicating cooperation with relevant authorities in the investigations.

The statement emphasized the bank’s commitment to accountability and transparency, pledging to address any misconduct in accordance with organizational policies, procedures, and ethical standards.

Recent developments in the case saw five former Equity Bank employees charged on March 20 with offenses including obtaining credit by false pretense and money laundering. They were remanded to prison pending further legal proceedings.

Subsequent police revelations disclosed the apprehension of two additional suspects, allegedly including Onyango, and three agent banking operators, amidst findings suggesting collusion between bank staff and certain agent banking operators.

In response to the situation, the Bank of Uganda has reportedly ordered a forensic audit of Equity Bank, reassuring depositors of the safety of their funds.

Onyango’s tenure at Equity Bank encompassed various roles, culminating in his oversight of commercial banking operations before his arrest in connection with the ongoing fraud investigation.

WhatsApp Follow Button

Follow @examinerug

Your Page Title

The Black Examiner®.

We come to you.

Want to send us a story or have an opinion to share? Send an email to editorial@examiner.co.ug or Join Our WhatsApp CHANNEL

https://examiner.co.ug/finance/equity-bank-ugandas-ex-ed-arrested-in-fraud-probe/?utm_source=rss&utm_medium=rss&utm_campaign=equity-bank-ugandas-ex-ed-arrested-in-fraud-probe

News

Ugandan Citizen Abducted, Held in Secret Detention for Three Months, Sparks Outrage and Calls for Justice

A disturbing new case of unlawful detention has surfaced, highlighting the ongoing human rights crisis in Uganda. A Ugandan citizen was reportedly abducted and held in a secret facility, known as a “safe house,” for three months, only to be released without charge or explanation. This incident, reported by NTV Uganda, has sparked widespread condemnation and renewed calls for accountability regarding human rights abuses in the country.

While the details surrounding the abduction remain unclear, reports indicate that the individual was taken without due process and held incommunicado—an action that has long been condemned by human rights organizations. The victim’s release, with no charges filed and no clear justification, has angered activists and citizens, who view this as yet another case of egregious abuse of power by the state.

“This is a recurring pattern,” said one human rights activist. “Abductions, secret detentions, and unexplained releases have become all too common in Uganda. These acts violate fundamental human rights and erode public trust in the justice system.”

The use of “safe houses,” unregistered detention facilities reportedly operated by security forces, has been a focal point in numerous allegations of torture and illegal imprisonment. Despite repeated calls from both local and international organizations for their closure and accountability for those involved, little action has been taken to address these violations.

This case underscores the urgent need for reform within Uganda’s security apparatus and greater accountability for human rights abuses. Observers hope that drawing attention to these injustices will spur concrete action to bring those responsible to justice and ensure the protection of basic human rights.

As frustration mounts, calls for both domestic and international pressure to hold the government accountable for such crimes grow louder. “One day, there must be accountability for all these crimes against our people,” stated one social media user, reflecting the sentiments of many Ugandans.

News

NUP Gathering Disrupted: Kyagulanyi Alleges Security Force Harassment and Arrests

National Unity Platform (NUP) President Robert Kyagulanyi has accused Ugandan security forces of using excessive force to disrupt a planned NUP gathering. The allegations were detailed in a statement shared on Twitter, following an event held to honor children of NUP supporters who were killed, disappeared, or detained for their political beliefs.

According to Kyagulanyi, security personnel, under the command of an officer identified as Asiimwe, carried out a preemptive operation early in the morning upon learning of the NUP’s plans. The forces allegedly stormed the premises, arrested workers, and deployed tear gas to disperse those present.

“The criminals under the command of one Asiimwe deployed early morning, arrested our workers, and threw tear gas into our premises. They’ve cordoned off the premises and blocked all people from accessing the place,” Kyagulanyi wrote.

Among those reportedly arrested were Saava Peter, Mudenya Samson, and Turyasingura Samson. Kyagulanyi claimed the detained workers were subjected to beatings and interrogated about their political affiliations, with security operatives labeling them as terrorists.

“These JATT operatives asked the workers who they support politically, branding them terrorists and criminals—their only crime being that they work with us. You can imagine the indignity!” Kyagulanyi lamented.

This incident adds to the growing tension in Uganda’s political climate, where opposition parties frequently accuse the government of stifling dissent. Despite the challenges, Kyagulanyi ended his statement with a message of defiance and optimism, proclaiming, “UGANDA WILL BE FREE.”

NUP Gathering Disrupted: Kyagulanyi Alleges Security Force Harassment and Arrests

News

Sudan Demands Apology from Uganda Over Army Chief Muhoozi Kainerugaba’s Threat to Invade Khartoum

Sudan has demanded an official apology from Uganda over “offensive and dangerous” comments made by the chief of Uganda army staff, who threated to invade Khartoum, the Sudan Tribune has reported.

General Muhoozi Kainerugaba, son of Ugandan President Yoweri Museveni and CDF of the Ugandan army, posted two comments on the X platform on Tuesday in which he threatened “to capture Khartoum” with the support of the US President elect Donald Trump after he takes office. The posts were deleted later.

“The government of Sudan demands and official apology from the Ugandan government for the offensive and dangerous comments of the army commander,” Sudan’s foreign ministry said in a statement that the Sudan Tribune said it has seen.

Sudan Demands Apology from Uganda Over Army Chief Muhoozi Kainerugaba’s Threat to Invade Khartoum